The Best Farm Accounting Software

On the other hand, farm managers are now able to oversee several processes at once. One of the most addictive parts of farming is dreaming about all the possibilities. Before you take that leap into the next market or next great idea be sure to run your idea through an enterprise budget exercise. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. This proficiency enables informed decision-making that contributes to a farm’s profitability and resilience.

Why are farm accountants essential in farm succession planning?

- If a farmer values livestock inventory at or lower than market value, IRS approval is not required to change to the unit-livestock-price method.

- Transitioning from the foundational principles of farm accounting, we now delve into the financial statements that serve as the bedrock of a farm’s financial reporting.

- While farming may be seen as a rustic and ancient way of getting back to the roots of nature, effective agriculture is inundated with cutting-edge technology.

- The core principles of farm accounting include accurate bookkeeping of all farming transactions and understanding depreciation and amortization of assets.

- Farmers can learn the status of each production cycle and gauge their success in relation to critical business functions through effective oversight of these sectors.

- While reasonably priced for small agricultural businesses, QuickBooks Online may be too expensive for part-time or hobby farmers.

The planting of one crop coincides with the harvest of another, and the sale of the second crop occurs when the first crop is gathered. A BACK OFFICE that combines field data with financial information will ensure the success of your activities. Business resource planning software will be designed for your farm to increase productivity throughout all phases of management. Profit centers are parts of a company that produce profits and revenue on a direct basis. By reducing expenses and boosting profits, the profit center is essential for carrying out management strategies and accounting for farms achieving profit objectives. Many farmers handle all of their profit centers through the same accounting system.

The Future of Agricultural Accounting

Despite its affordable price, it delivers the key functions we expect from farm accounting software. QuickBooks Online Plus is our overall best farm accounting software because it is customizable to nearly any business type. Its biggest advantage is that businesses and accountants widely use it, so it has a large network of QuickBooks ProAdvisors. This makes it easy for you to seek help if you need professional bookkeeping support and guidance. Using accounting software for farm systems, farm accounting management https://x.com/BooksTimeInc covers all facets of production, including agricultural production, supply chain management, and human resources, t o name a few.

- Under some circumstances — such as if revenue exceeds $5 million on the PnL statement — agriculture businesses may be required to utilize either the accrual method of accounting or a hybrid of accrual and cash method.

- The IRS lets certain farm businesses postpone reporting the gain from additional animal sales if you can prove that the sale was weather-related.

- Under the accrual method, revenue and expenses are recorded as they are earned, regardless of when the money is received or paid.

- On top of both hard and soft technology, the internet can be a farmer’s best friend.

- To help you stay on top of your agricultural accounting responsibilities, you may consider using accounting software to handle your day-to-day recordkeeping and hiring an accountant.

What are the core principles of farm accounting?

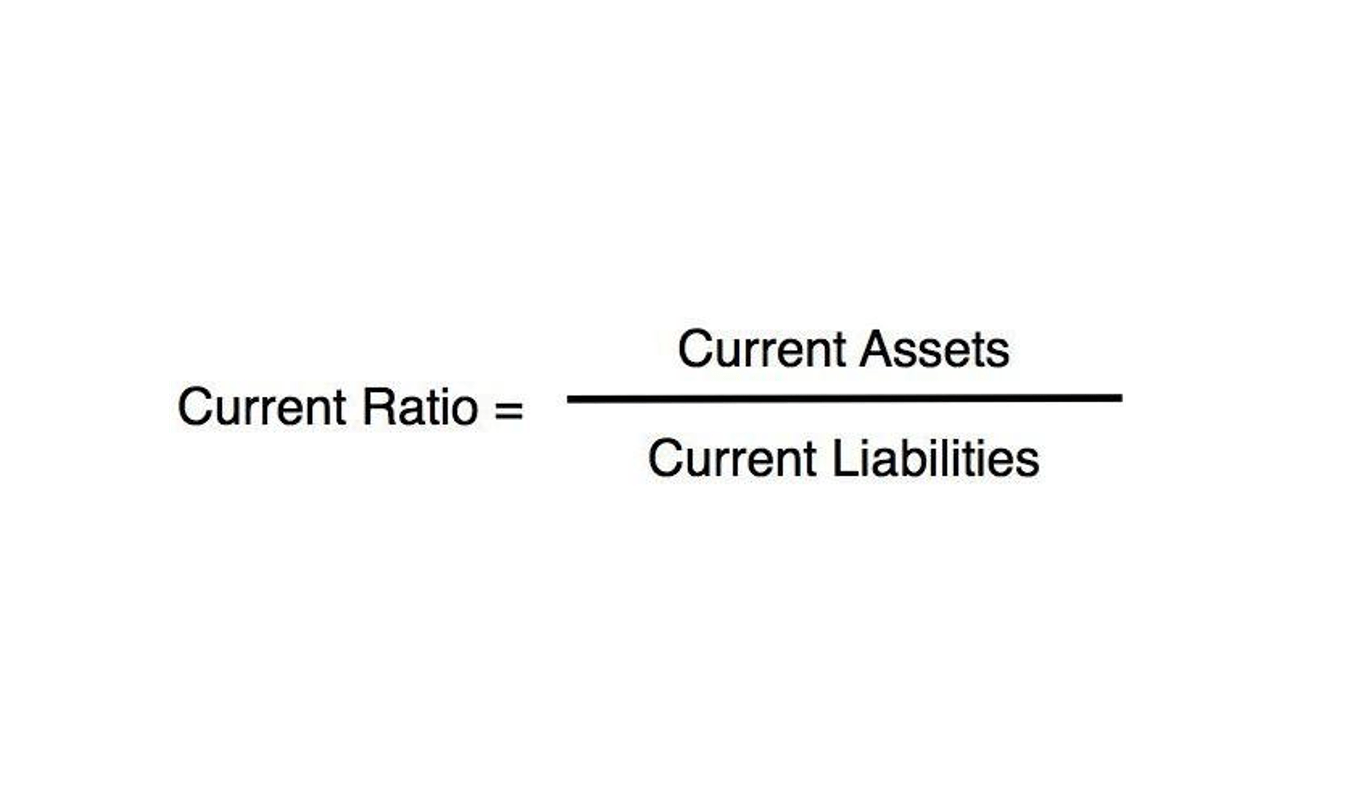

For more industry-specific tracking and reporting features, you can integrate both products with Figured, farm-specific financial planning and reporting software. Liquidity ratios, such as the current ratio and the quick ratio, assess a farm’s ability to meet short-term obligations without selling inventory or making other significant changes to operations. Solvency ratios, including the debt-to-asset ratio and the https://www.bookstime.com/articles/what-is-a-bookkeeper equity-to-asset ratio, provide insights into the farm’s long-term financial stability and its capacity to withstand adverse economic conditions.

Popular Accounting Software for Farmers

With a farm accountant’s guidance, farmers can confidently navigate the lending landscape and select loan options that best align with their financial capabilities and business goals. They highlight the farm’s assets, liabilities, income, and expenditure, helping farmers identify financial trends, growth opportunities, and potential financial hurdles. Farm accountants extend their role beyond tax planning to financial analysis and budgeting, shaping a farm’s financial future.